Indian pharmaceutical industry

The Indian pharmaceutical industry, the most respected amongst the emerging nations, is one of the most sought after sectors from a global collaboration point of view. Having a strong macro and socio economic foundation, the "driving" factors are intrinsically deep-rooted in the Indian pharmaceutical sector and have not been deterred by recent speed breakers like quality issues faced by a few Indian companies.

The Indian pharmaceutical market is highly fragmented with 300 large and 18,000 mid-sized and small companies. It is a successful, high-technology-based industry that has witnessed consistent growth over the past three decades. The Indian pharma industry (IPM) accounts for about 1.4 per cent of the world's pharma industry in value terms and 10 per cent in volume terms.

The Indian pharmaceuticals market is third largest in terms of volume and thirteen largest in terms of value, as per a pharmaceuticals sector analysis report by equity master. The market is dominated majorly by branded generics which constitute nearly 70 to 80 per cent of the market. Considered to be a highly fragmented industry,consolidation has increasingly become an important feature of the Indian pharmaceutical market.

India has achieved an eminent global position in pharma sector. The country also has a huge pool of scientists and engineers who have the potential to take the industry to a very high level. The UN-backed Medicines Patents Pool has signed six sub-licences with Aurobindo, Cipla, Desano, Emcure, Hetero Labs and Laurus Labs, allowing them to make generic anti-AIDS medicine Tenofovir Alafenamide (TAF) for 112 developing countries.

The Indian pharmaceutical sector offers a lot to be optimistic about. The sector which was only $ six billion in 2005, has zoomed to $18 billion market in 2012, clocking a CAGR of 17 per cent. The sector is expected to grow to $45 billion by 2020. Even in the most pessimistic scenario, the sector is expected to be the sixth largest in the world in terms of absolute size by 2020.

The sector stands to benefit from various domestic and international driving factors. On the domestic front, the sector is expected to register a strong double-digit growth of 13-14 per cent in 2013 on back of increasing sales of generic medicines, continued growth in chronic therapies and a greater penetration in rural markets. Favorable factors such as increase in affordability driven by rise in per capita income, wider insurance penetration are also key growth drivers.

Exports continue to make a significant contribution to the industry growth story. Critical and developed markets like the US are driving growth in the generics segment. The “patent cliff” , the impending expiry of patents worth $ 148 billion is expected to buoy export oriented Indian generic companies. Apart from the developed markets, Indian pharmaceuticals companies have established a strong presence in other fast growing semi-regulated markets like Russia, South Africa and Latin America. The president Obama’s healthcare plan, popularly known as Obamacare is also a positive development for Indian players as it increases the scope of supplying high quality affordable drugs to the American markets. Currently, India’s share of the US generic market is 24 per cent in terms of volume and 40 per cent of the new product approvals granted by the US FDA has been to Indian companies (YTD 2013). It has established a strong reputation in the global space for being a high quality supplier of affordable generics. In order to promote the sector, the regulatory authorities must not curb the inflow of funds as it will have a cascading affect that will adversely impact the outflow.

One of the key characteristics of the Indian pharmaceuticals industry is the fact that it is very fragmented. The largest domestic market shareholders hold about seven per cent of the Indian markets, while the top 10 companies command about 40 per cent of the market share. On the other hand, India has the highest generic penetration of over 99 per cent and provides equal access to both large and small players.

The Indian pharmaceuticals sector is at the threshold of exponential growth. It is believed that the Indian pharmaceuticals market will be amongst the top three global markets in terms of incremental growth by 2020. Curbing inbound M&A will adversely affect the pillar of globalization that currently supports this dynamic and fast growing sector. The Indian pharmaceuticals segment should continue to be a two-way street that offers a win-win situation for both domestic as well as multinational pharmaceuticals companies.

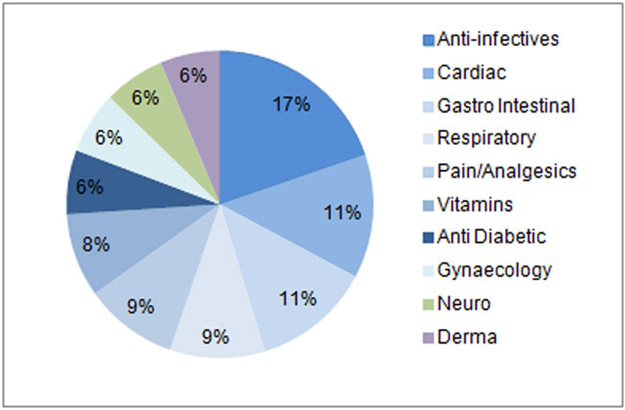

Top ten therapeutic segments in the Indian audited pharmaceutical sales (2014)

| Therapy |

Sales (Val in Cr.) |

% Growth |

|

82311 |

9% |

| Anti-Infective |

12158 |

1% |

| Cardiac |

9600 |

9% |

| Gastro Intestinal |

8681 |

10% |

| Pain/Analgesics |

6646 |

8% |

| Respiratory |

6572 |

11% |

| Vitamins/Minerals/Nutrients |

6476 |

12% |

| Anti Diabetics |

6186 |

18% |

| Derma |

5006 |

18% |

| Neuro/CNS |

4807 |

8% |

| Gynae |

4540 |

9% |

Top ten organization of Indian pharmaceutical Industry (2014)

| Therapy |

Sales (Val in Cr.) |

Market Share |

% Growth |

|

82311 |

82311 |

9% |

| Abott |

5368 |

7 |

4% |

| Cipla |

4132 |

5 |

12% |

| Sun |

3909 |

5 |

17% |

| Zydus Cadila |

3114 |

4 |

5% |

| Ranbaxy |

3066 |

4 |

0% |

| GlaxoSmithKline |

2923 |

4 |

-4% |

| Alkem |

2873 |

3 |

14% |

| Mankind |

2788 |

3 |

12% |

| Pfizer |

2533 |

3 |

6% |

| Macleodes Pharma |

2505 |

3 |

19% |

Top ten products of Indian pharmaceutical Industry (2014)

| Therapy |

Sales (Val in Cr.) |

% Growth |

|

82311 |

9% |

| Corex |

312 |

1% |

| Augmentin |

265 |

9% |

| Monocef |

249 |

10% |

| Volini |

244 |

8% |

| Glycomet-GP |

244 |

11% |

| Human Mixtard 30/70 |

239 |

12% |

| Phensedyl Cough |

238 |

18% |

| Dexorange |

237 |

18% |

| Revital |

229 |

8% |

| Voveran |

215 |

9% |

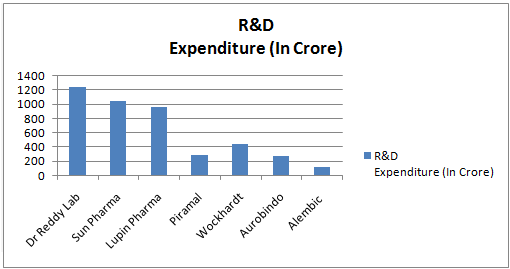

Research and development is the key to the future of pharma industry. The tough increasing competition has emphasised India’s Pharma companies to invest in Research and Development (R&D The Research and Development (R&D) spending of 25 leading Indian pharmaceutical companies increased by 20.6 per cent to Rs. 6,103 crore during the year 2013-14 from Rs. 5,060 crore in the previous year. With higher R&D investments, Indian companies secured 81 ANDA approvals from US FDA during the first eight months i.e. January-August 2014 which worked out to almost 31 per cent of total ANDA approved during this period. For the last three years the R&D investment as percentage of net sales of Pharmabiz sample of 25 pharmaceutical companies worked out to over 7 per cent despite higher growth in net sales.

Research & Development Progress of Indian Pharmaceuticals Industry (2014)

| Company |

Overview of R&D Program |

| Dr Reddy

Laboratories Ltd

Hyderabad

|

DRL's R&D expenditure increased sharply by over 62 per cent to Rs 1240.00 crore during 2013-14 and worked out to 9.4 per cent of sales. The company filed 12 ANDAs and one NDA in US and its cumulative filings reached at 209. Further, 62 ANDAs are pending approval as at the end of March 2014, of which 39 are Para IV filings of which 9 are believed to have First-to-File status. The company filed 12 DMFs in US, 13 in Europe and 26 in other countries. There were 631 cumulative DMF filings. DRL has set up 8 R&D centers across the globe |

| Lupin Limited Mumbai |

Lupin's consolidated R&D expenditure increased by 24.4 per cent to Rs. 958 crore in 2013-14 and it received 45 approvals in key advanced markets including 22 and one supplemental NDA in the US, 10 in EU, 6 in Australia, 5 in Canada and 2 in Japan. It also filed 19 ANDAs with US and 4 MAAs with European regulatory authorities. Its cumulative ANDA filings with US FDA stood at 192 with 99 approvals. It has 30 confirmed first-to-file including 15 exclusive ones. Its ADDS programme received further project milestone payments aggregating US$ 8.8 million. |

| Sun Pharmaceuticals Industries Ltd

Vadodara

|

Sun standalone R&D expenditure increased by 36.2 per cent to Rs 422.39 crore during 2013-14 and its consolidated R&D expenditure increased to Rs 1,042 crore from Rs 704.2 crore in the previous year. Sun filed 27 ANDa and received US FDA approval for 26 ANDAs and 134 products await approval, including 12 tentative approvals. Its cumulative ANDAs filed reached at 478 with total approval of 344 ANDAs. Its patents, together with those of Taro, have reached 573 filings and 346 were granted patents as of 31st March, 2014. The Sun filed 15 DMF/CEPs during 2013-14 and cumulative DMF reached at 256 |

| Piramal Healthcare Ltd Mumbai |

The company's drug discovery and development unit is focusing on the discovery and development of innovative small molecule medicines in the therapy areas of oncology and metabolic disorders. The Mumbai R&D unit has made significant progress with an R&D pipeline having several molecules in different phases of development. Currently major development programs are in phase I/II studies. In oncology, P276, P1446,P7171 and PL225B are in phase I/II studies. In diabetes and metabolic disorder, P1736, P11187, and P7435 are in phase I/II studies. |

| Alembic Pharma

Vadodara

|

R&D expenditure went up sharply to Rs 129.56 crore from Rs 76.27 crore in the previous year. During 2013-14, it filed 8 DMFs and 4 ANDAs including 2 'First to File'. The cumulative ANDA filings stood at 61 and it received approval for 32 products till March 31, 2014. So far, the company filed 580 patents for APIs and 228 patents for formulations. Its introduced High specialty Ophthalmic range in the domestic market. |

| Wockhardt |

Wockhardt's standalone R&D expenditure moved up to Rs. 242 crore from Rs. 219 crore in the previous year. However, its consolidated R&D spending increased to Rs. 450 crore from Rs. 376 crore and worked out to 9.7 per cent of total sales. Wockhardt established R&D centres in India, US and Europe to cater to the technological needs of the products. It is focusing on biotechnology programme in developing biosimilars of insulin and its analogs. |

| Aurobindo |

Aurobindo's standalone R&D spending increased to Rs. 271 crore during 2013-14 from Rs. 233 crore in the previous year. Aurobindo filed 78 ANDAs with US FDA during 2013-14 and cumulative filing reached at 336 ANDAs with approval of 195 ANDAs. It also filed 18 DMFs and cumulative filing of DMFs reached at 190. |